[Update 2025] Current status of Vietnam's manufacturing industry, challenges and future outook

Vietnam's Manufacturing Industry: Current Status, Challenges, and Future Outlook [Update 2025]

What is the current status of Vietnam's manufacturing industry, challenges, and future outlook in 2025, and why does it matter now more than ever? As global supply chains shift and investment pours into Southeast Asia, Vietnam stands out as a rising industrial powerhouse. From key sectors and wage trends to major players and government policies, this article explores the full picture of the Vietnam industry—its strengths, hurdles, and future opportunities.

Overview of Vietnam’s Manufacturing Industry in 2025

Overview of Vietnam’s manufacturing industry 2025 (Source)

Vietnam’s manufacturing sector continues to be a cornerstone of its economic growth in 2025.

Key Sectors Driving Vietnam’s Manufacturing Growth

Several key sectors are propelling Vietnam's manufacturing expansion:

- Electronics and Electrical Equipment: Companies like Samsung and Foxconn have significantly invested in Vietnam, making electronics a leading export sector.

- Textiles and Garments: Vietnam remains one of the world's top exporters, supplying major global brands.

- Footwear: The country is the second-largest exporter of shoes globally, benefiting from shifts in global supply chains.

- Furniture: Vietnam's furniture manufacturing sector is growing, catering to international markets with high-quality products.

- Food Processing and Agricultural Products: These industries are expanding to meet domestic and international demand.

- Emerging Sectors: Automotive and machinery production is gaining momentum and attracting new investments.

Statistical Snapshot: Production Volume, Export Value, and Workforce Size

Vietnam's manufacturing sector has shown impressive statistics in 2025:

- Manufacturing Output: Expected to hit around USD 108.7 billion, growing at a compound annual rate of 3.33% between 2025 and 2029.

- Export Value: Vietnam aims for an annual export revenue of USD 454 billion by the end of 2025, reflecting a 12% year-on-year increase

- Workforce Size: The manufacturing sector employs a significant portion of the labor force, with ongoing efforts to enhance skill development to meet industry demands.

These figures underscore the sector's vital role in the Vietnam industry and its contribution to the national economy.

Impact of Global Trade Agreements on Vietnam’s Manufacturing

Vietnam's participation in multiple free trade agreements (FTAs) has significantly influenced its manufacturing sector:

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and EU-Vietnam Free Trade Agreement (EVFTA): These agreements have opened access to major markets, reducing tariffs and encouraging foreign investment.

- Bilateral Agreements: Vietnam continues to negotiate and implement FTAs with countries across Asia, Europe, and the Americas, further integrating into global supply chains.

Major Industries Thriving in Vietnam Today

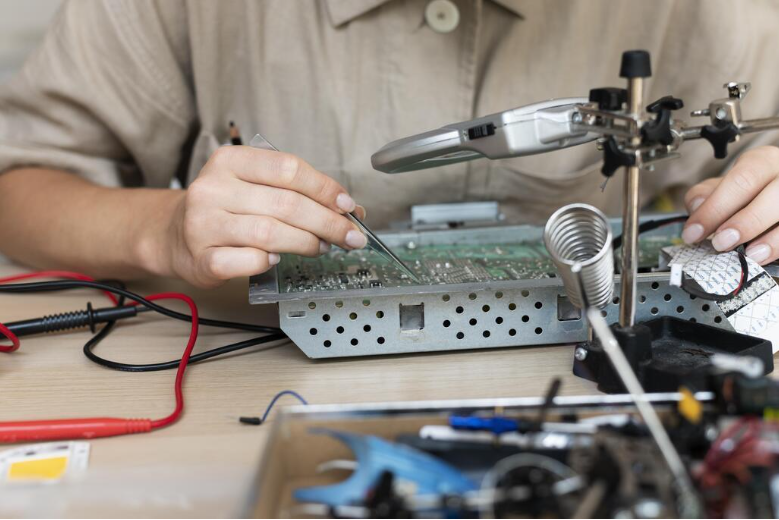

Electronics and Electrical Equipment Manufacturing

Electrical Equipment Manufacturing (Source)

Electronics and electrical equipment manufacturing is a leading sector in Vietnam's industrial landscape. In 2023, electronics manufacturing generated $115 billion in revenue, over a quarter of the country's GDP. Major global companies, such as Samsung and Foxconn, have significantly invested in Vietnam, making electronics a leading export sector.

Textile and Garment Industry’s Role in Vietnam’s Economy

Textile and Garment Industry (Source)

The textile and garment industry remains a vital component of the Vietnam industry. As of April 15, 2025, Vietnam's total textile and garment export turnover reached $1.8 billion, representing an 8.7% increase compared to the same period in 2024. The sector includes around 7,000 companies and provides jobs for more than three million people, with 80% of its production capacity dedicated to exports.

Food Processing and Agricultural Products Manufacturing

Food processing (Source)

Vietnam's food processing industry is experiencing steady growth. In 2024, the industry grew by 7.4% to reach $79.3 billion. The sector comprises approximately 11,000 companies, contributing significantly to the Vietnam industry. The expansion is driven by increasing domestic prosperity and government support for economic growth.

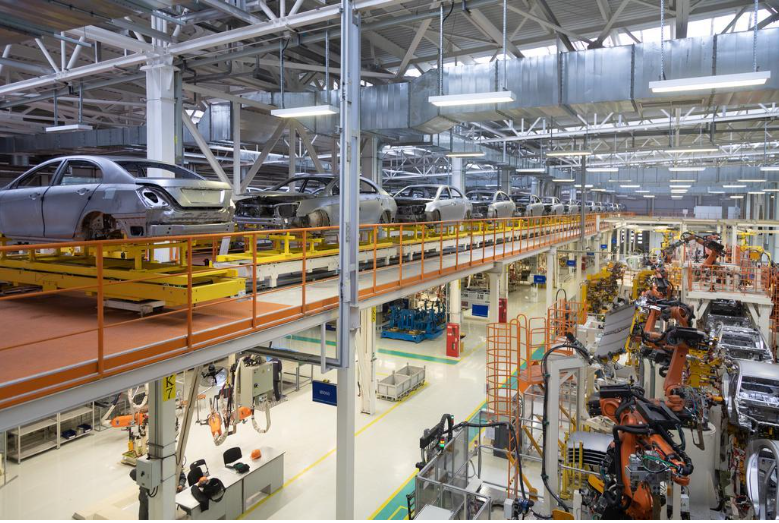

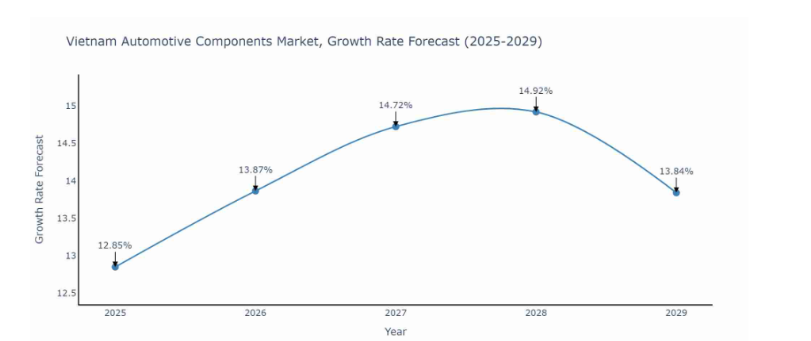

Emerging Sectors: Automotive and Machinery Production

Automotive and Machinery Production (Source)

The automotive and machinery production sector is emerging as a significant contributor to Vietnam's manufacturing industry. Nearly 70% of vehicles sold in 2023 were built domestically, yet only a fifth of their components came from local production, underscoring the sector’s dependence on imported materials. From 2025 to 2029, the automotive components sector is forecasted to show fluctuating growth, peaking at 14.92% in 2028.

Notable Manufacturers and FDI Players in Vietnam

Global Brands Investing in Vietnam

Several global corporations have committed major investments to Vietnam:

- Samsung has invested over $23 billion, employing over 200,000 people and making Vietnam its largest production base outside South Korea.

- LG Innotek is expanding its production in Hai Phong with an investment of VND6.8 trillion to enhance camera module manufacturing.

- Lego opened a $1 billion factory in Binh Duong, aiming to operate entirely on clean energy by 2026.

- Sanofi and VNVC launched a vaccine manufacturing facility in Long An province, with an initial investment of approximately $77 million.

Rising Vietnamese Manufacturers

Rising Vietnamese manufacturers (Source)

Domestic companies are also making significant strides:

- VinFast, a subsidiary of Vingroup, is expanding its electric vehicle production with a new plant in Ha Tinh province, aiming to produce 300,000 units annually.

- THACO (Truong Hai Group Corporation) remains a leading automobile manufacturer, with a production capacity of 71,000 units per year.

Manufacturing Clusters by Region

Vietnam's industrial zones are strategically distributed:

- Northern Region: Bac Ninh and Thai Nguyen provinces host major electronics manufacturers like Samsung and Foxconn.

- Southern Region: Binh Duong and Dong Nai provinces are hubs for diverse industries, including electronics, automotive, and food processing.

- Central Region: Nam Dinh province is developing new industrial clusters focusing on sectors like pharmaceuticals and automotive parts

Wage Trends and Labor Market in Vietnam’s Manufacturing Sector

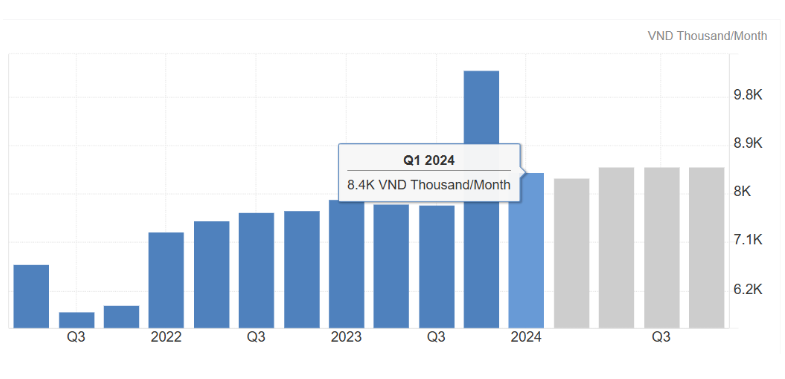

Wage trends (Source)

Current Wage Levels and Regional Variations

Q1 2024 (Source)

As of the first quarter of 2025, the average monthly wage for manufacturing workers in Vietnam is approximately VND 8.4 million (around USD 332), reflecting a continued rise in labor costs. This increase is partly due to a 6% minimum wage hike implemented in July 2024. Wage levels vary across regions, with urban areas like Ho Chi Minh City and Hanoi offering higher salaries than rural provinces, aligning with differences in living costs and industrial development.

Labor Supply and Skill Development Challenges

Vietnam’s manufacturing sector, along with construction, engaged approximately 17.4 million workers in 2024, reflecting a substantial share of the country’s workforce. However, the industry faces challenges related to skill development. Labor productivity in Vietnam remains lower compared to neighboring countries, highlighting the need for enhanced vocational training and education to meet the demands of modern manufacturing processes.

Government Policies Affecting Labor Costs and Workforce Quality

The Vietnamese government has implemented policies to improve workforce quality and manage labor costs. Initiatives include vocational training programs and educational reforms designed to align the labor force's skills with industry requirements. These efforts support the Vietnam industry by fostering a more skilled and adaptable workforce, essential for sustaining growth in the manufacturing sector.

Challenges Facing Vietnam’s Manufacturing Industry in 2025

Challenges facing Vietnam’s manufacturing industry in 2025 (Source)

Supply Chain Disruptions and Raw Material Shortages

Vietnam's manufacturing sector heavily relies on imported raw materials, particularly from China. This dependence exposes the industry to global supply chain disruptions, leading to production delays and increased costs. For instance, the textile and garment industry has faced significant challenges due to raw material shortages, impacting output and export commitments.

Rising Labor Costs and Regional Competition

Labor costs in Vietnam have been rising, with monthly wages ranging from $250 to $400, still lower than China's $500 to $800 but gradually increasing. This upward trend, coupled with competition from neighboring countries like Indonesia and Bangladesh, threatens Vietnam's cost competitiveness in the manufacturing sector.

Environmental Regulations and Sustainability Pressures

The Vietnamese government has implemented stricter environmental regulations, including Decree 05/2025/ND-CP, which mandates comprehensive waste management and sustainability practices for manufacturers. Compliance with these regulations requires significant investment in eco-friendly technologies and processes, adding to operational costs.

Infrastructure and Technology Adoption Hurdles

While Vietnam has made strides in infrastructure development, challenges persist in logistics and technology adoption. Limited access to advanced machinery and digital technologies hampers productivity and efficiency in the manufacturing sector. Delays and elevated logistics costs can arise from inadequate transport infrastructure.

Future Outlook of Vietnam’s Manufacturing Sector [2025–2030]

Future Outlook of Vietnam’s Manufacturing Sector (Source)

Vietnam’s Role in the Global Supply Chain

Vietnam is strengthening its role as a major force in global manufacturing. By 2025, the country aims to achieve $454 billion in export revenue, marking a 12% increase from the previous year. This growth is attributed to Vietnam's strategic location, competitive labor costs, and robust trade agreements, making it an attractive destination for foreign investment and supply chain diversification.

Technological Advancements and Automation Trends

Adopting automation and advanced technologies is accelerating within Vietnam's manufacturing sector. The industrial automation sector is forecasted to increase at a CAGR of 2.38% between 2024 and 2028. This surge is fueled by the increasing implementation of robotics and automation solutions to enhance productivity and efficiency.

Advancements in Smart Manufacturing and Technology Adoption

Smart manufacturing (Source)

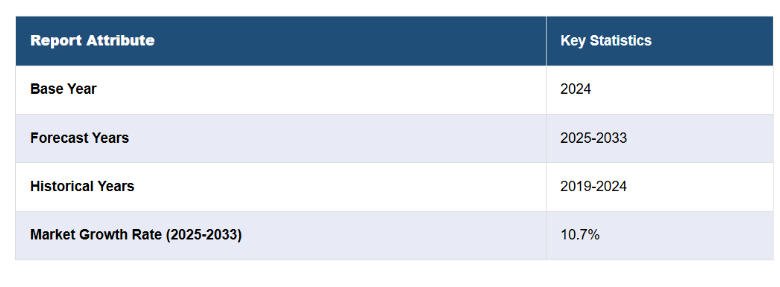

Smart manufacturing is gaining momentum in Vietnam, with the market expected to grow at a CAGR of 10.7% from 2025 to 2033. The government's National Strategy for Industry 4.0 is a key driver, promoting the integration of technologies such as AI, IoT, and data analytics to modernize manufacturing processes and improve competitiveness.

Policy Support and Free Trade Agreements (FTAs)

Vietnam's extensive network of Free Trade Agreements (FTAs), including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), plays a crucial role in its manufacturing sector's growth. These agreements facilitate access to international markets, reduce tariffs, and attract foreign investment, strengthening the Vietnam industry's global integration.

Why Kizuna is a Strategic Choice for Manufacturers in Vietnam

Kizuna is a strategic partner for manufacturers seeking to establish or expand operations in Vietnam. Its ready-built serviced factory complexes offer a comprehensive ecosystem tailored to the evolving demands of the Vietnam industry.

- With its location in Long An Province, Kizuna connects easily to Ho Chi Minh City and major transport hubs, promoting efficient logistics and supply chain flow. The facilities range from 250m² to 80,000m², accommodating diverse manufacturing needs. Each unit is equipped with synchronized technical infrastructure, including dual power sources with 100% backup capacity and high-speed broadband IT systems.

- Beyond infrastructure, Kizuna offers multilingual support services, catering to Japanese, Korean, and English-speaking clients, ensuring smooth communication and operations. The industrial park also boasts shared utilities such as business centers, canteens, and 24/7 security, creating a conducive environment for productivity.

- With over 100 FDI manufacturers from sectors like high technology, electronic components, and precision engineering operating within its premises, Kizuna exemplifies a thriving industrial community. Its strategic location, comprehensive services, and commitment to excellence make it a preferred choice for businesses aiming to capitalize on the growth of the Vietnam industry.

Frequently Asked Questions about Vietnam’s Manufacturing Industry

What are the major industries flourishing in Vietnam?

Vietnam's manufacturing landscape is diverse, with key industries including textiles and garments, electronics, footwear, furniture, and home décor.

How much are wages in Vietnam’s manufacturing sector?

As of Q1 2025, the average monthly wage in Vietnam's manufacturing sector is approximately 8.3 million VND (around $321).

Who are some of the famous manufacturers in Vietnam?

Prominent manufacturers operating in Vietnam include Samsung, Nike, Intel, Adidas, LG, The North Face, and Foxconn, reflecting the country's integration into global supply chains.

What is the core industry driving Vietnam’s economy?

Manufacturing is a key engine of the Vietnam industry, generating more than 40% of GDP, with around 30% coming specifically from processing and manufacturing.