New regulations on Social Insurance from 2018

1. Add new subjects to compulsory social insurance

According to clause 1, article 124 of the Social Insurance Law in 2014, from January 1st, 2018, new subjects to compulsory social insurance include:

– The employees working under labor contracts of a definite term between one full month and under three months.

– The foreigners working in Vietnam with work permits or practice certificates or practice licenses granted by competent Vietnamese authorities will be subject to compulsory social insurance.

It means people working under temporary or part-time labor contracts of a definite term between one full month and under three months and foreigners working in Vietnam are required to participate in compulsory social insurance.

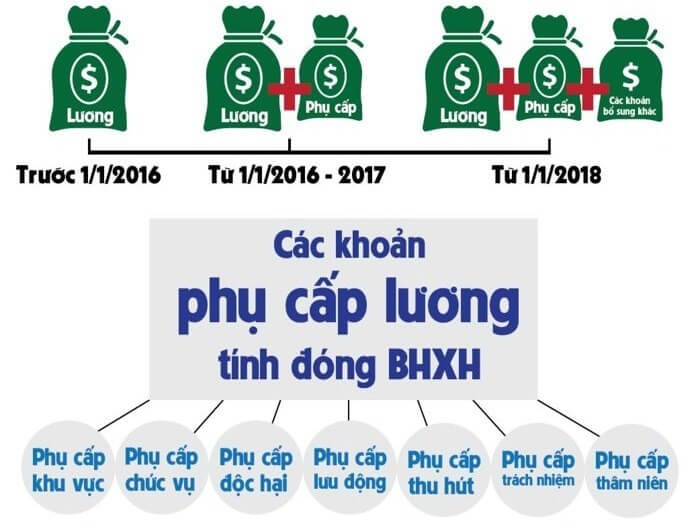

2. Increase monthly salary for social insurance contribution

The monthly salary paid for social insurance from January 1st, 2018 onwards include: basic salary, allowances and other additional payments as stipulated by labor legislation in Clause 3, Article 4 of Circular 47/2015/TT-BLDTBXH issued November 16th, 2015 of Ministry of Labor, War Invalids and Social Affairs.

| Subjected to Social insurance | Not subjected to social insurance |

|

1. Salary 2. Allowances The allowances to offset the factors of working conditions, the complexity of work, living conditions, hot job in labor market that the salary in the labor contract cannot cover, such as: – Positional allowance; – Responsibility allowance; – Heavy Duty allowance, Hazard allowance, Danger allowance; – Loyalty allowance; – Regional allowance; – Mobile allowance – Attractional allowance; – Other similar allowances (with the same characteristics). |

Bonus / Incentive/ Welfare – Bonus as regulated in Article 103 of Labor Code – Innovation bonus; – Mid-Shift Meal; – Gazoline support; Phone support; Transportation support; Housing support; Child care support; baby subvention. – welfare for employee’s family funeral; – welfare for employee’s family wedding; – welfare for employee’s birthday; – welfare when employee is in difficult circumstances i.e suffering from occupational accidents or diseases. – Other special welfares which are defined by a separated part in the Labor Contract as regulated by Item 11, Article 4 Decree 05/2015/NĐ-CP |

3. Evading payment of SHUI shall be liable to a fine of imprisonment for individuals, fines for legal entities

In Article 216 of Criminal Code in 2015 (amended in 2017), a person who is responsible for paying compulsory social insurance, health insurance and unemployment insurance but use tricks tounpay or pays insufficiently for 06 months or more despite the fact that the employer has incurred an administrative penalty for the same offense shall be liable to a fine of from 50,000,000 VND to 200,000,000 VND or face a penalty of up to 01 years’ community sentence or 03 – 12 months’ imprisonment.

– The amount of insurance contribution evaded is from 50,000,000 VND to under 300,000,000 VND;

– The offenders evades paying pay insurance for 10 – 49 workers.

This offense committed in any of following circumstances carries a fine of from 200,000,000 VND to 500,000,000 VND or a penalty of 03 – 36 months ‘imprisonment:

– The offense has been committed more than once;

– The amount of insurance contribution evaded is from 300,000,000 VND to under 1,000,000,000 VND;

– The offenders fails to pay insurance for 50 -199 workers;

– The offenders collects or deducts insurance contribution from the workers as prescribed in above regulations but fails to pay insurance.

Punishments incurred by a legal entity shall be liable to a fine of from 500,000,000 VND to under 1,000,000,000 VND

This offense committed in any of following circumstances carries a fine of from 500,000,000 VND to 1,000,000,000 VND or a penalty of 02-07 years’ imprisonment:

– The amount of insurance contribution evaded is 1,000,000,000 or more;

– The offenders fails to pay insurance for 200 workers or more;

– The offenders collects or deducts insurance contribution from the workers as prescribed in above regulations but fails to pay insurance.

The offender might also be liable to a fine of from 20,000,000 VND to 100,000,000 VND, be prohibited from holding certain positions or doing certain works for 01 – 05 years.

Punishments incurred by a person legal entity shall be liable to a fine of from 1,000,000,000 VND to 3,000,000,000 VND.

Source: Labor Department of LAEZA